Why Patent Valuation Matters

Patent valuation is more than a number—it's a strategic asset that propels your business forward. Understanding the value of your patents enables:

FAQs

How do I place an order for a single patent or patent portfolio valuation report?

To order a patent valuation report:

1. From the "Store" drop down menu, select the report product page that you are interested in.

2. From the single patent valuation report or patent portfolio valuation report page, enter the quantity of report to purchase and select "Add to cart".

3. Select "View cart".

4. In the "Order special instructions" window, enter the patent number or numbers you would like the report generated for.

5. Select "Check out".

6. Enter contact information, preferably email, and payment information. Enter a discount code if you have one.

7. Select "Pay now".

When we receive your order, we will verify that a valuation monetary value can be calculated for your patent(s). In cases where a patent is not valid (abandoned, not yet granted), we may not be able to generate a report. In that case, we will not accept payment and will notify you.

How do I place an order for an IP landscape report?

MRT Patents generates an IP landscape report that is customized to your company. We use a description of your innovation, technology, products and/or business model to do a semantic search of a huge international patent database and create a report for your company based on the results.

To order an IP landscape report:

1. From the "Store" drop down menu, select the landscape report product page.

2. From the IP landscape report page, enter the quantity of report to purchase and select "Add to cart".

3. Select "View cart".

4. In the "Order special instructions" window, enter one or more paragraphs describing your innovation, technology, products and/or business model or provide a link to your website with such a description.

5. Select "Check out".

6. Enter contact information, preferably email, and payment information. Enter a discount code if you have one.

7. Select "Pay now".

When we receive your order, we will verify that a detailed IP landscape report can be generated based on the information you provide.

In cases where we need additional detail to generate a thorough report that has business value to you, we will contact you for clarification on your instructions. In that case, we will not accept payment until we clarify with you the instructions.

How are reports delivered?

Reports are delivered in pdf form using a service called Filemonk. We securely upload your custom report to Filemonk.

You will receive an email regarding your order entitled "Your MRT Patents /Order number/ content" with a button link "Access Downloads". Click on "Access Downloads" and you will be redirected to Filemonk to download your report.

What is the lead time to get a report?

It depends on our backlog but typically 1 to 5 days. If you need a report immediately, for example to include a monetary value in an investor pitch coming up shortly, please email us at the Contact Us email and we may be able to expedite for you.

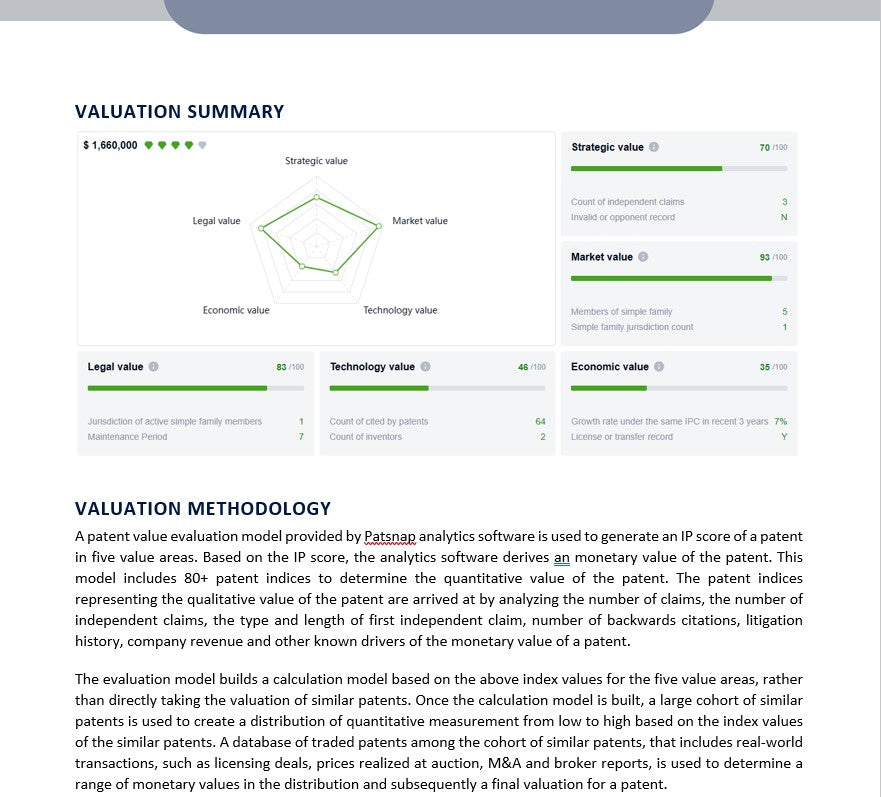

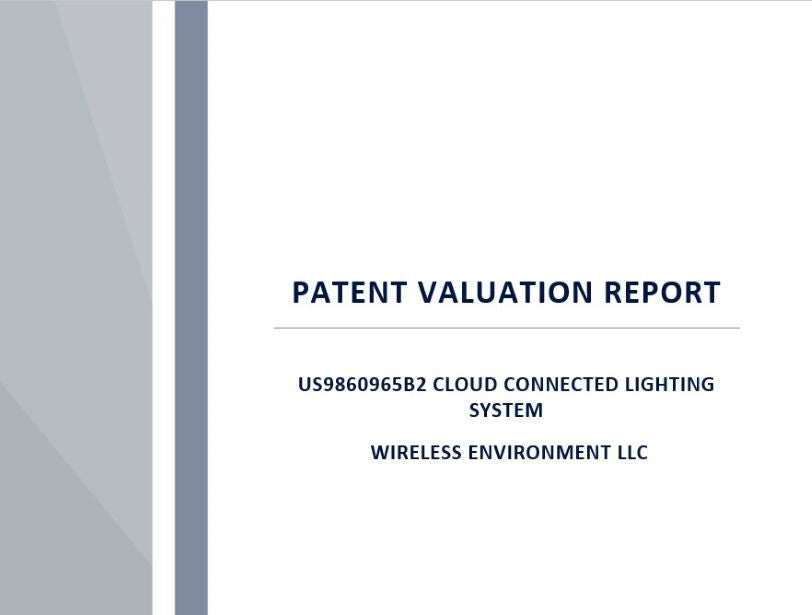

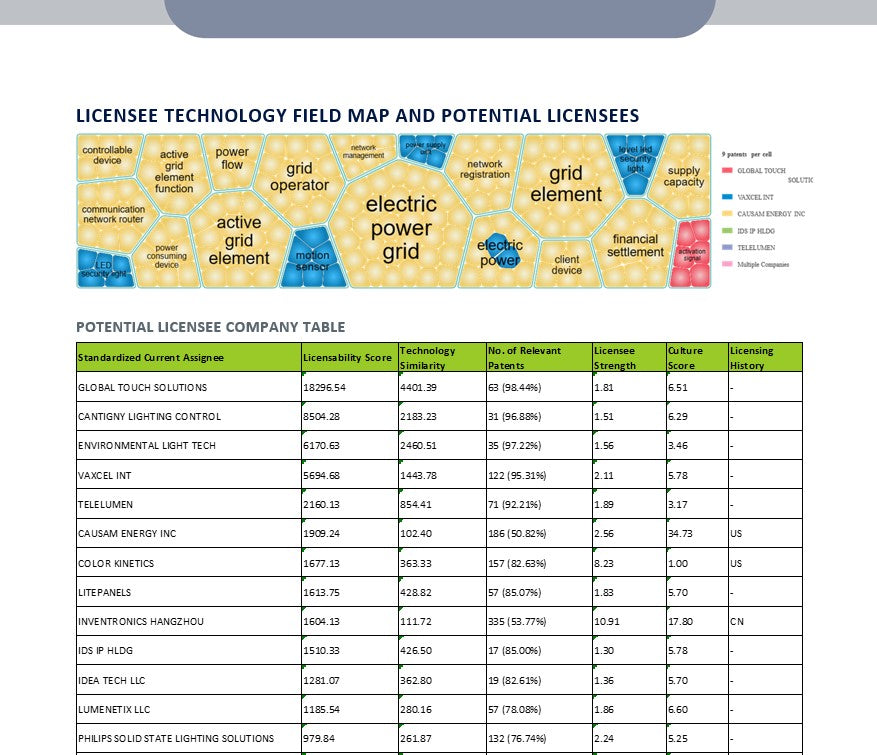

How do you arrive at the monetary value for a patent?

Patent valuation is a process used to assign a financial value to a patent during the innovation process, to determine its monetary worth. This provides a method of defining the competitiveness and tradability of the patent.

MRT patents uses patent analytics software that generates a large set of proven indicators, currently 80+, taking different aspects of the patent(s) into account. The indicators use pieces of information contained in the patent documents (including forward and backward citations, family sizes, patent age, etc.) and are compiled in such a way as to consider the possible changes that can occur over time in different technology fields, thus future proofing the methodology.

Based on this qualitative analysis using market indicators, the patent analytics software then uses machine learning based on real-world transactions such as licensing deals, auction results and M&A to arrive at a monetary value.

Note there are several ways, qualitatively and quantitatively, to arrive a monetary value for a patent(s). Different methods may arrive at different values. We believe that the method we use has business value for startup through medium sized businesses, tech transfer agencies, the investment community and others to "get a number" that is coupled with background information that allows you to evaluate your patents(s) for use for strategic business purposes.

What is MRT Patents legal disclaimer?

Each report contains the following legal disclaimer:

MRT Consulting Group, LLC avoids being liable for any decisions made by outsourced data: This report (including any annexes) will bring you exclusive rights and interests. If this report is used for any other special purpose or used by the third party for special use, MRT Consulting Group, LLC, including its employees, partners and agents will assume no liability. All information in this report is provided strictly on an "as is" basis, with no guarantee of information’s completeness, accuracy and the correctness of the results. No express or implied warranty, and no explanation for no particular purpose are included in this report. Under no circumstances will MRT Consulting Group, LLC, with its employees, partners and agents be liable for any final decisions and losses caused by information and analysis results included in this report. Unless MRT Consulting Group, LLC provides prior written consent, no part of this report can be reprinted, distributed or transmitted to any third party.

How can a customer in India send payment?

MRT Patents apologizes for any difficulty in payment processing for customers in India. We now accept payment by crypto. If a crypto payment method does not work and you would still like to order a report, please contact mike@mrtpatents.com and we can arrange payment via invoice and a payment method that is acceptable for orders from India.

Can I get an example report?

For serious customers only, please email info@mrtpatents.com and we will arrange to send you a portion of or a complete report to show you what you would receive when you order one of our MRT Patents reports.

How to contact us?

If the information provided on this website needs clarification, please contact us at mike@mrtconsultinggroup.com. If necessary, we can get on a call to answer questions, provide more information or discuss special projects. Thank you for considering us/